What is EMV?

What is EMV?

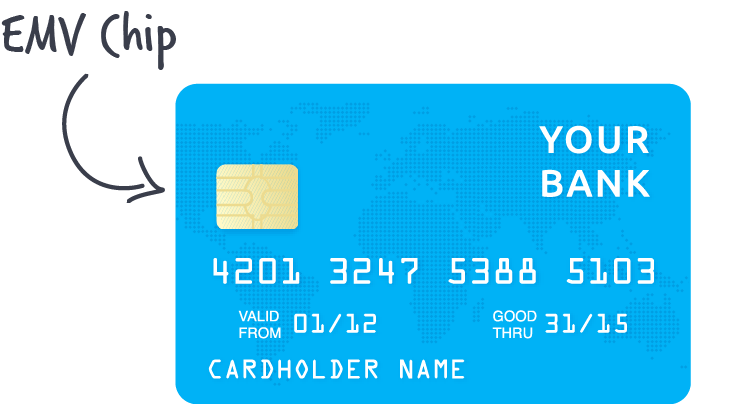

If you haven’t seen or heard yet, you soon will—here’s is a quick rundown. EMV or Europay, MasterCard, VISA (named after the companies that originated the payment standard) is a data-driven form to increase security and protect against fraudulent charges while paying at the register. EMV is known as a smart-payment system that uses an embedded chip containing microprocessors on a credit or debit card, similar to a SIM card in a cell phone, which transfers payment information from a person’s card to the merchant. Already adopted throughout most parts of the world (Europe, Canada, Latin America Middle East and so on), the US is one of the last countries to enact in this standard. These are also know as Chip Cards

Small Size, Big Benefits

Although small in size, the chip contains a lot of fragile information that is significant to safeguard—a loss of this can cause major problems. Within the embedded chip lays the microprocessor, much like a computer. The way it works is pretty simple: when the card is used at a terminal, the data becomes fully encrypted by the chip. That means that while you’re paying for the double latte, your name, card number, expirations date and security code are all being scrambled and decoded. This happens every time you pay with EMV; this way data cannot be copied or lifted by a third-party. Ah, technology, neat when you think about it.

If you haven’t seen or heard yet, you soon will—here’s is a quick rundown. EMV or Europay, MasterCard, VISA (named after the companies that originated the payment standard) is a data-driven form to increase security and protect against fraudulent charges while paying at the register. EMV is known as a smart-payment system that uses an embedded chip containing microprocessors on a credit or debit card, similar to a SIM card in a cell phone, which transfers payment information from a person’s card to the merchant. Already adopted throughout most parts of the world (Europe, Canada, Latin America Middle East and so on), the US is one of the last countries to enact in this standard. These are also know as Chip Cards

Small Size, Big Benefits

Although small in size, the chip contains a lot of fragile information that is significant to safeguard—a loss of this can cause major problems. Within the embedded chip lays the microprocessor, much like a computer. The way it works is pretty simple: when the card is used at a terminal, the data becomes fully encrypted by the chip. That means that while you’re paying for the double latte, your name, card number, expirations date and security code are all being scrambled and decoded. This happens every time you pay with EMV; this way data cannot be copied or lifted by a third-party. Ah, technology, neat when you think about it.