|

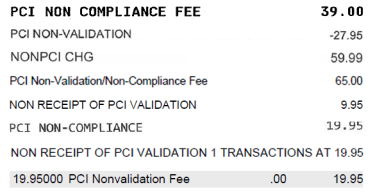

This post is about how many processors use PCI as a way to charge you a fee and increase their revenue. PCI stands for “payment card industry” and it’s the first half of the acronym PCI-DSS. The second part stands for “data security standards.” While you may see the full term PCI-DSS, it’s more common to see just “PCI.” However, it refers to the same set of standards. While it is true that a business that accepts credit cards, per the rules of the card brands, is required to complete an annual Self-Assessment Questionnaire or SAQ. The card brands do not charge the processor for PCI. A business that accepts credit cards some of the fees they might see on a processing statement is PCI Non-compliance fee. This fee usually is charged to a business for not completing their annual SAQ on time. We believe it is a reasonable position as it encourage a business to be in compliance. Here is where it can get tricky. I have heard complaints from businesses that have completed the SAQ, still got charged a PCI Non-compliance fee. Also if you have the representative that helps you with your processing account, they should actively contact the business and remind the urgency to complete the SAQ to avoid a non-compliance fee. With many of our competitors they will charge you a monthly, quarterly or annual PCI Program fees. They can be described in many ways. See a sample below. The difference with our service is we will not charge you PCI program fees. We will work with you to be sure you have completed your SAQ so you will not be charged a non-compliance fee. This is what set us apart with many other companies and services. We are involved at the beginning to help board your account and we continue to work with you and support every aspects in your processing account. If you looking for TLC and extra attention with your credit card processing services, we got you covered.

Let us know how we can help with PCI or anything else related to credit card processing and point of sales system, contact us at 404-999-7874. Comments are closed.

|

APS Blog

Point of sale (POS) credit card processing solutions in Atlanta, GA Archives

June 2024

Categories

All

|

Atlanta Payment Solutions

"Solutions, Savings & Service"

Atlanta, GA 30625

"Solutions, Savings & Service"

Atlanta, GA 30625

Credit card processing for small business.

Serving the greater Atlanta metropolitan area, including Buford.

Atlanta Merchant Services

Admin | Privacy

Site powered by eCoalitions.net

© 2024 Atlanta Payment Solutions

Serving the greater Atlanta metropolitan area, including Buford.

Atlanta Merchant Services

Admin | Privacy

Site powered by eCoalitions.net

© 2024 Atlanta Payment Solutions

RSS Feed

RSS Feed